By Don Loepp

EDITOR

Published: August 27, 2014 12:19 pm ET

Updated: August 27, 2014 12:23 pm ET

Image By: Rich Williams

Company CEOs are typically big supporters of capitalism and the free market, and they should be. It’s a great system for raising the standard of living, rewarding hard work and encouraging efficiency.

Every once in a while, though, they get caught up in some very anti-capitalistic thoughts.

Witness the recent comments of Chrysler CEO Sergio Marchionne, who said when he sees the healthy balance sheets of automotive suppliers, it makes his “blood pressure go up.”

Marchionne wants a piece of the action.

Try to forget for a minute that Chrysler just reported that its second quarter sales were up 14 percent from the same period a year ago — to $20.5 billion — and net profit was up 22 percent for the same period, to $619 million.

That profit margin may be too slim for Marchionne’s liking, but it’s definitely in the black. And the trend looks pretty nice. Some automotive suppliers are doing better, but that shouldn’t be a problem, when you’re looking at the issue from an economics perspective.

Shouldn’t OEMs want their suppliers to be profitable? That puts them in good shape to invest in new capacity and to continue to improve their efficiency.

Doesn’t Chrysler have quite a bit of power in its relationship with suppliers? Of course it does. There aren’t many automotive OEMs out there. Auto suppliers are addicted to the high volume of business that they get from companies like Chrysler.

We all know that the alternative to having healthy suppliers — having suppliers that are in financial trouble — is a recipe for trouble. And not too long ago, auto suppliers and OEMs were looking across the negotiating table from each other, wondering who would be the first to file for Chapter 11 … or worse.

But Marchionne isn’t alone.

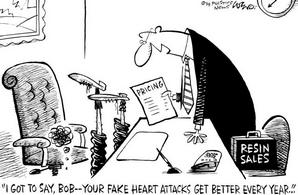

Plastics processors sometimes make the same sorts of comments about profit margins at their suppliers. In this case, we’re talking about resin suppliers.

I admit, I would be a terrible resin salesman. How could I look a plastics processor in the eye and say I need another 2 or 3 cents per pound for raw material, blaming higher feedstock costs, when I knew the customer can see my company’s strong quarterly earnings reports?

But that’s how the business works. It’s rare for processors to complain out loud, or on the record. But they do complain.

I have a strong suspicion that quite a few plastics processor managers invest their own personal savings in resin and chemical company stocks. Because they know that in the vast supply chains in which they operate, the raw material suppliers have it pretty good these days.

Still, you know what they say: past performance is no guarantee of future results. That’s a key point for the Marchionnes of the world to keep in mind. Automotive suppliers need to invest in capacity to serve their growing customers — and that investment carries risk. The same applies to resin suppliers. And there’s no shortage of investment these days, in all corners of the plastics industry. |